Principles of Corporate Finance, 14th Edition

Richard A. Brealey, Stewart C. Myers, Franklin Allen, Alex Edmans

Print: 9781265074159/ Ebook: 9781265652463

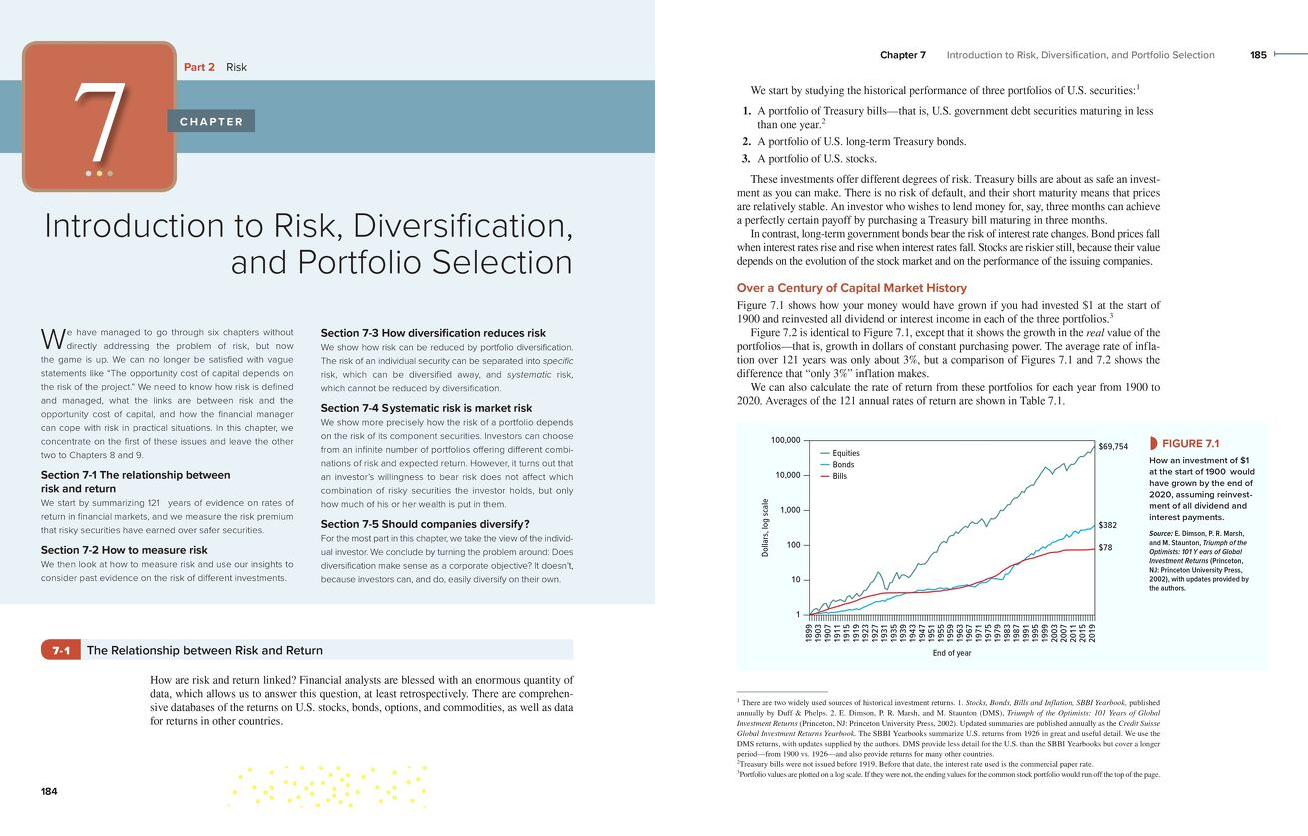

The latest in the Principles of Corporate Finance dynasty, serving the best business programmes in the world for decades, the 14th edition continues in its tradition of showing how theory applies to the very practical problems and decisions faced by financial managers.

Looking at what financial managers do and why, the book aims to give readers a solid understanding of theory so that they know what questions to ask when times change and new problems need to be analysed, eventually standing as a reference and a guide to help them make financial decisions, not just study them.

This new edition welcomes Alex Edmans to the author team, whose global authority and expertise in corporate governance, responsible business and behavioural finance have been invaluable in bolstering coverage of these topics.

What's new?

Responsible Business

The idea that companies should promote the interests of all stakeholders rather than simply seeking to maximize shareholder value is an important one. The new edition includes a new chapter that discusses these different corporate objectives, how far they conflict, and how a responsible business should behave.

Market Efficiency

The discussion of market efficiency has been substantially revised, with an expanded discussion of behavioural finance and the evidence for behavioural biases, challenging the Efficient Markets Hypothesis/Rational Economic Man assumption that has pervaded thinking for decades.

Going Global

As the modern finance manager works in a global environment, they need to understand the financial systems of other countries. Recent editions have progressively introduced more international material, and this edition features material on international differences in financing as well as discussion of governance systems around the world.

About the authors

Richard A. Brealey

Emeritus Professor of Finance at London Business School. He is the former president of the European Finance Association and a former director of the American Finance Association. He is a fellow of the British Academy and has served as a special adviser to the Governor of the Bank of England and director of a number of financial institutions. Other books written by Professor Brealey include Introduction to Risk and Return from Common Stocks.

Stewart C. Myers

Emeritus Professor of Financial Economics at MIT’s Sloan School of Management. He is past president of the American Finance Association, a research associate at the National Bureau of Economic Research, a principal of the Brattle Group Inc., and a retired director of Entergy Corporation. His research is primarily concerned with the valuation of real and financial assets, corporate financial policy, and financial aspects of government regulation of business. He is the author of influential research papers on many topics, including adjusted present value, rate of return regulation, pricing and capital allocation in insurance, real options, and moral hazard and information issues in capital structure decisions.

Franklin Allen

Professor of Finance and Economics, Imperial College London, and Emeritus Nippon Life Professor of Finance at the Wharton School of the University of Pennsylvania. He is past president of the American Finance Association, Western Finance Association, Society for Financial Studies, Financial Intermediation Research Society, and Financial Management Association. His research has focused on financial innovation, asset price bubbles, comparing financial systems, and financial crises. He is Director of the Brevan Howard Centre for Financial Analysis at Imperial College Business School.

Alex Edmans

Professor of Finance at London Business School and Mercers School Memorial Professor of Business at Gresham College. He is also Managing Editor of the Review of Finance and was previously a tenured professor at Wharton, where he won 14 teaching awards in six years. His research focuses on corporate finance, responsible business, and behavioral finance. He has spoken at the World Economic Forum in Davos, given the TED talk “What to Trust in a Post-Truth World” and the TEDx talk “The Social Responsibility of Business”; he is also advisor to several investment management companies. He is the author of Grow the Pie: How Great Companies Deliver Both Purpose and Profit. Poets & Quants named him MBA Professor of the Year for 2021.

Transform learning: boost grades, stimulate engagement and deliver an amazing course

Connect is an online platform integrating ready-made course content with assessment and tools. The platform uses the most established adaptive digital technology to deliver a more effective learning experience for both students and educators across over 90 disciplines.

Connect has changed the paradigm from students adapting to the classroom to education adapting to each student. Connect’s interactive technology provides each student with a tailored learning journey enabling them to learn at their own pace and in their own way.

Request a review copy

To access your digital version of your Review Copy please complete the form below and we'll make the title available for you on our partner website - VitalSource - when it becomes available. Simply complete this form to take your next step on your learning journey with McGraw Hill.

*Please note that the printed book won't be available in for delivery until June. We recommend requesting an e-sample so you can review it as soon as possible.